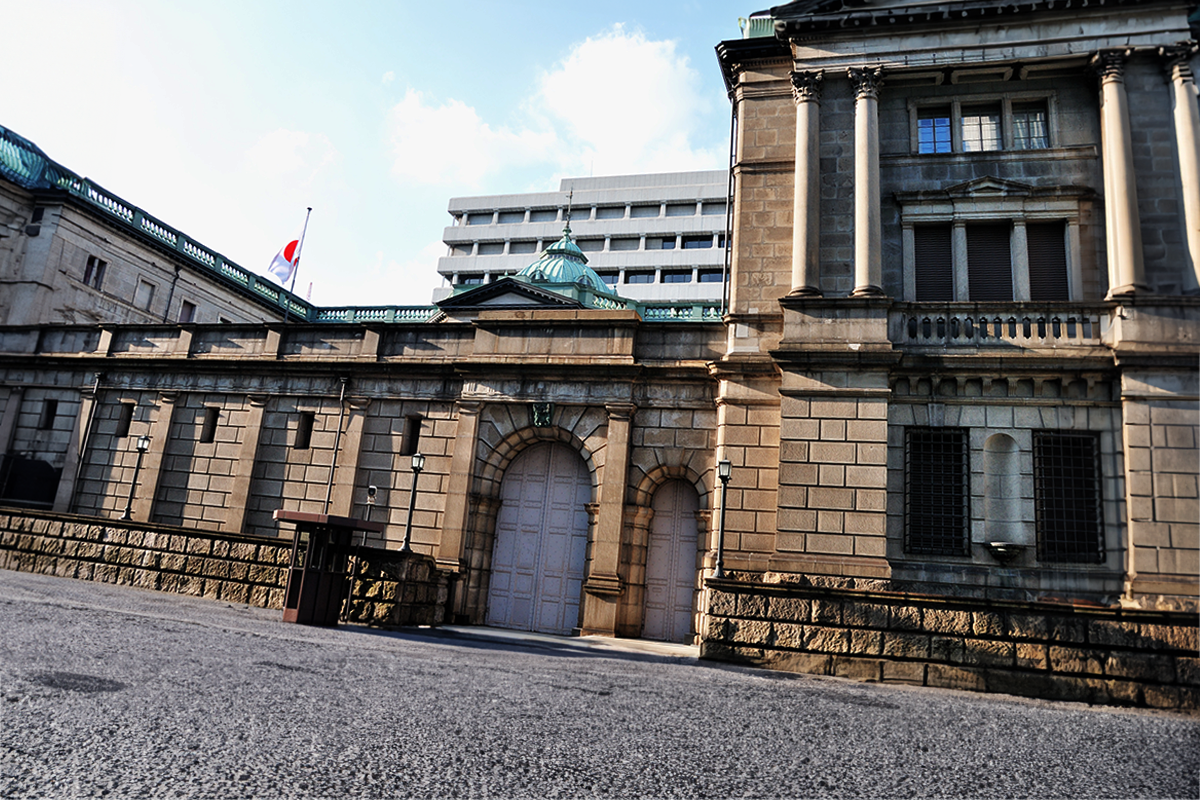

In a significant move with global implications, the Bank of Japan (BOJ) announced its decision to raise interest rates for the first time since 2007. This milestone marks a departure from the unprecedented era of negative interest rates, which had persisted globally since 2012. The decision comes as Japan’s economy exhibits promising signs of growth, with the Nikkei index recently surpassing its record-high from 1989 and indicators of rising prices and wages.

The BOJ, in a statement released on Tuesday, articulated its confidence in the Japanese economy, describing it as being in a “virtuous cycle” between wages and prices. This cycle suggests that wage increases are sufficient to offset rising prices without undermining business profits. The central bank also projected a steady increase in wages for the current year, building upon the firm wage growth observed in the previous year.

The impact of these developments extends beyond Japan’s borders, particularly to the United States, given Japan’s status as the largest foreign holder of US debt, currently standing at $1.1 trillion. An article by Yumi Teso and Masaki Kondo in Bloomberg last year warned of the potential consequences of the BOJ’s rate hike, as perceived by MLIV Pulse respondents.

According to the report, 37% of participants anticipated that US Treasuries would face the most severe impact from the BOJ’s decision. This anticipation stems from the expectation that higher yields in Japan would prompt Japanese investors to repatriate funds that currently are held in US, European, and Australian debt. Treasuries, traditionally regarded as a stable component in many investment portfolios, are already exhibiting heightened volatility.

The confluence of factors, including the Federal Reserve’s aggressive policy tightening and the surge in bond sales by the US government has resulted in historical losses, especially on long-duration debt. The BOJ’s move to raise rates introduces further complexity into this landscape, potentially amplifying market turbulence and reshaping investment strategies.

US bond auctions have been less than stellar for months and you have to wonder if the BOJ decision could be a wake-up call for policymakers in Washington who are currently preparing to finish up negotiations on the final piece of a massive six-bill minibus package of FY2024 spending bills. Will they finally try and get spending under control or continue business as normal?