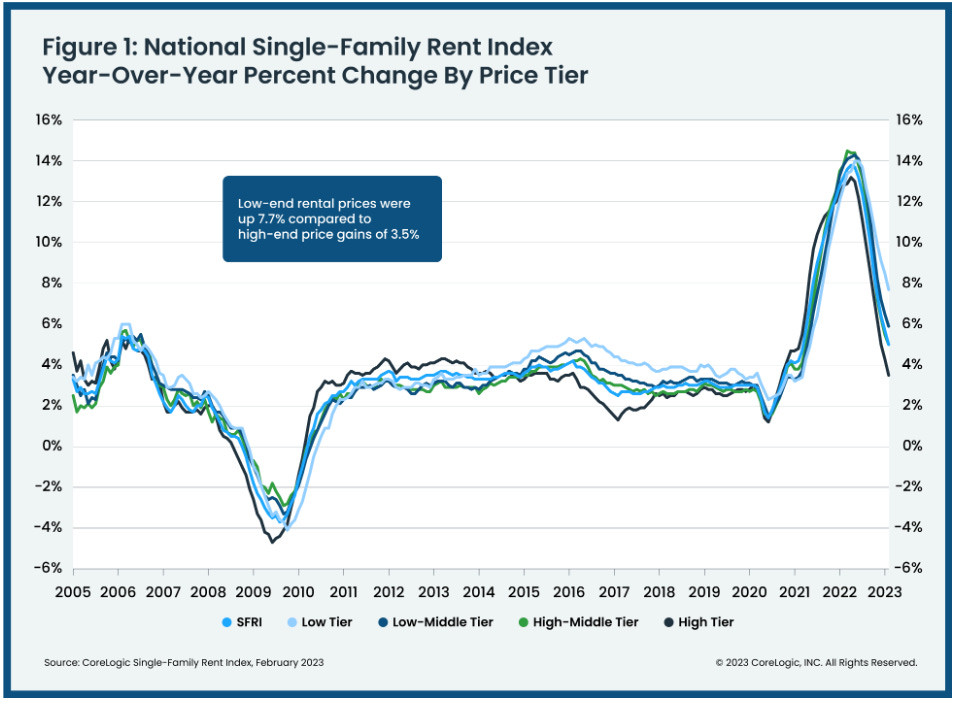

Single-family rent growth fell for the 10th straight month in February, according to the CoreLogic Single-Family Rent Index.

- U.S. single-family rent price growth slowed to 5% in February, down from 5.7% in January and is now at the lowest level since March 2021.

- Rent growth is now down 9 percentage points from an all-time high of 14% in April 2022.

Low Still High. All price tiers fell in February but the Low-priced tier continues to see the most growth with rent up 7.7% year-over-year, down from 8.5% in January. Lower-middle was second highest with 5.9% growth followed by higher-middle and higher-priced up 5.0% and 3.5%, respectively.

Gimme Some MO. St. Louis jumped into the top spot with a year-over-year increase of 7.8% in February. Charlotte and Orlando were close behind with growth of 7.7%.

- On the flip side, Las Vegas and Phoenix saw the lowest annual rent price growth, both at 0.3%.

Analysis. Molly Boesel, principal economist at CoreLogic, notes that lower-income borrowers continue to be hit the hardest as raising rates is not just an inconvenience but can prevent them from being able to buy. “Less-expensive metros have emerged as those with the highest appreciating rental costs, as tenants contend with elevated rents and inflation. However, while the top U.S. metros for rental cost growth are increasing annually by about 8%, that is well below the rates of 20% to 40% seen one year ago.”

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.